Investment on Power Sector in Summer Season is Good or Not?

Investment on Power Sector in Summer Season is Good or Not?

India power generation including renewable resources is 1381.82(bu) in 2020-2021 and 1389.10(bu) in 2019-2020 respectively. Current year till January-2022 is 1234.29(BU) up by 8.48% from past year.

Current year Peak demand is 2,03,014 (MW), demand met is 2,00,539 (MW) and deficit is -2,475 (-1.2%).

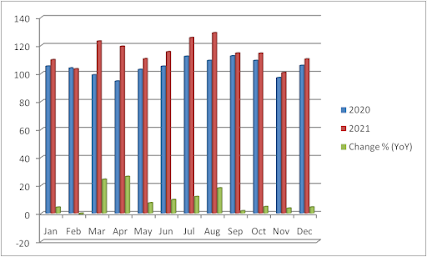

Power Consumption grows every year from March to August. Now its best opportunity to buy power stocks.

- Figure showing Power Consumption in India month on month

Analyses of some of these companies and there performance

over the year is provided below:-

- IEX has given 124% return over the year.

- Tata Power has given 157% return over the year.

- Adani Power has given 75% return over the year.

- JSW Energy has given 293% return over the year.

Some important factors

to be considered are:-

- IEX have 100% monopoly in Electricity Exchange in India. The company has been a proven investment multiplier in past years.

- Tata Power has monopoly in Charging Station Points for EV in India. The company has also significant market share in retail Electricity segment. The company recently signed MOU with Enviro to deploy 59 EV charging points in Gurugram Haryana. Company has already installed 1000+ EV charging points all over in India. It’s the first company to accomplish this.

- Adani Power the name speaks itself. The company has signed MOU of Power supply with Punjab Government of 6100 MW. The company has multiple projects of Power Supply to various states.

- JSW Energy has signed 240 MW Power supply pact with Haryana Government and has major share in Green Power and Hydro Power. The company gets order of 810 MW wind turbine supply from GE Renewal Energy.

Let’s check the Valuation of these

Companies:-

The Company’s Revenue trend Quarterly and Yearly is provided below:-

The Company’s Profitability Quarterly and Yearly is provided below:-

GREEN TRADE

Munish Mahajan

Disclaimer: - All the information provided here is only for Educational Purpose. We do not have any personal position in this stock and we are not promoting this company. Please take the Advice of your financial Consultant before taking any decision.

Comments

Post a Comment