“Nayi Udaan ki Nayi Zimmedari :- Yes Bank” Opportunity or Trap.

“Nayi

Udaan ki Nayi Zimmedari :- Yes Bank” Opportunity or Trap.

Headline In Last Week

1. In Budget, Government take initiative of Bad Bank for solving the Growing NPA Crisis.

2. After Budget 2021 presentation, stocks of IndusInd Bank, ICICI Bank, SBI, RBL Bank goes up by more than 9%.

3. Yes Bank’s Consolidated December 2020, Net Interest Income (NII) at Rs 2,560.94 crore, up 141.23% Y-o-Y.

4. ‘Nayi Udaan Ki Nayi Zimmedari’: Yes Bank launches Unique offerings for MSMEs to strengthen segment.

About Yes Bank

YES BANK, is a high quality, customer centric and service driven Bank. Since inception in 2004, YES BANK has grown into a ‘Full Service Commercial Bank’ providing a complete range of products, services and technology driven digital offerings, catering to corporate, MSME & retail customers. Yes Bank provides you an all-inclusive banking experience through an extensive branch banking network of over 1000 Branches and 1,800 ATMs. Yes Bank is Listed Under BSE and NSE with a stock price of Rs.16.90. Last week Company reported its result. In which Company Net Interest Income (NII) at Rs 2,560.94 crore in December 2020 up 141.23% from Rs. 1061.61 crore in December 2019. Quarterly Net Profit at Rs. 147.68 crore in December 2020 up 100.8% from Rs. 18,564.24 crore in December 2019. Operating Profit stands at Rs. 2,282.52 crore in December 2020 up 18172.21% from Rs. 12.63 crore in December 2019. Yes Bank EPS has increased to Rs. 0.06 in December 2020 from Rs. 72.97 in December 2019.

My Point of View

Yes

Bank Limited is an Indian private sector bank. Yes Bank story is very Up and

down. A Leading Bank to Grab Bank. One time the share price of Yes Bank in

Aug-18 is 400 and Now below 20.

Let’s

discuss the main point:-

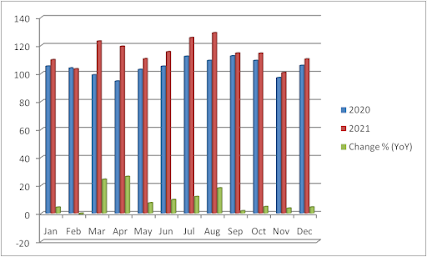

- 1. Company Improving its Profit and decreasing its expenditure. Take a look on quarterly results:-

- 2. After Budget 2021 presentation, stocks of ICICI Bank, SBI, HDFC Bank, Kotak Bank and RBL Bank up by more than 11% except Yes Bank. We can see big move in Yes Bank in coming days.

- 3. Company decreases its NPA from last few quarters. Its Net NPA in December is 4.04% down from September’s 4.71%.

- 4. FII increase their Shareholding in December Quarter to 15.01 from 11.16.

- 5. Stock Price and Market Cap. The Stock price of Yes Bank is very degraded from highs. If we compare the stock price of Yes Bank with other banks, it is bottom on the list. Only 7 Banks are cheaper than Yes Bank which are not very common to us. If we check the market cap of the Yes Bank it’s the 8th Largest Bank of India, It’s Shocking but true.

- 6. In Budget, Govt take initiative of Bad Bank for solving the growing NPA Crisis. If such thing happens, we can see the new high of the Yes Bank. Recently the share Circuit limit changed to 20% from earlier 5%. It is a better sign to invest in Yes Bank.

Let us discuss the Strengths, Weakness, Opportunities and

Treats (SWOT) of the Yes Bank

·

Strengths

Ø

Growth in Net Profit with increasing Profit

Margin (QoQ)

Ø

Increasing profits every quarter for the past 2

quarters

Ø

FII / FPI or Institutions increasing their

shareholding

Ø

Recent Results: Growth in Operating Profit with

increase in operating margins (YoY)

·

Weaknesses

Ø

Annual net profit declining for last 2 years

Ø

Inefficient use of shareholder funds - ROE

declining in the last 2 years

Ø

Inefficient use of assets to generate profits -

ROA declining in the last 2 years

Ø

MFs decreased their shareholding last quarter

Ø

Recent Results : Growth in Operating Profit with

increase in operating margins (YoY)

Ø

Declining Net Cash Flow and Cash from Operating

Activity for last 2 years

·

Opportunities

Ø

Brokers upgraded recommendation or target price

in the past three months

Ø

Highest Recovery from 52 Week Low

Ø

Decrease in NPA in recent results

·

Threats

Ø

Increasing Trend in Non-Core Income

Ø

Increase in Provisions in Recent Results

Munish Mahajan

Disclaimer:

All my views here are backed on my own research and it is

just for spreading awareness and for educational purpose only, I do not have

ant intentions to manipulate the markets. I may or may not have invested in the

above-mentioned securities.

Looking forward to it

ReplyDelete