Is IEX (Indian Energy Exchange) next Adani Green?

Is IEX (Indian Energy Exchange) next Adani Green?

About IEX

IEX (Indian Energy Exchange Limited) is the first and

largest energy exchange in India providing a nationwide, automated trading

platform for physical delivery of electricity, Renewable Energy Certificates

and Energy Saving Certificates. The exchange platform enables efficient price

discovery and increases the accessibility and transparency of the power market

in India while also enhancing the speed and efficiency of trade execution.

Today, more than 6600 participants are registered on our

exchange from 29 States, 5 Union Territories (UTs). Over 4,800 registered

participants were eligible to trade electricity contracts and over 4,400

registered participants were eligible to trade RECs, as of February 2020.

Headline in

Last Few Weeks

- 1. IEX hits new high on stake sale: IEX on March 10 announced a strategic divestment of 26 per cent of its equity holding in the Indian Gas Exchange to NSE through its wholly owned subsidiary NSE Investments Ltd and an additional 5 per cent equity holding to ONGC.

- 2. IEX scales new high in a weak market, rallies 22% in seven days.

- 3. Buy Indian Energy Exchange, target price Rs.430: ICICI Direct

- 4. IEX give 50% Return in just 47 days. If you had invested Rs.1,00,000 on 01-Feb-2021 in it, it would be Rs.1,50,000 today.

My point of

view

The Indian Energy Exchange (IEX) is an Indian government

owned electronic system based power trading exchange regulated by the Central

Electricity Regulatory Commission (CERC). IEX started its operations on June

27, 2008. Indian Energy Exchange pioneered the development of power trading in

India and provides an electronic platform to the various participants in power

market, comprising State Electricity Boards, Power producers, Power Traders and

Open Access Consumers (both Industrial & Commercial).

IEX is the one of the shares which I recommend on my last

blog, here is the link (https://analysiswithmunish.blogspot.com/2021/01/betting-on-electric-vehiclesrenewal.html).

But, here I will discuss only IEX.

I think this stock has all the things required to become a

multi-bagger and I am very much positive that it will reach new highs in coming

months. When I say that this stock is next Adani Green I really mean it as it

has potential to become next Adani Green.

Let’s discuss the points which attract IEX:-

· IEX is India’s first and largest energy exchange providing a nationwide, automated trading platform for physical delivery of electricity, Renewable Energy Certificates and Energy Saving Certificates. Renewable Energy and Physical delivery of Electricity is Next Generation thinking.

· Company Revenue or Profit Growth: Let us see the financial of IEX. Company revenue or profit increases on QOQ basis which is a good sign for the investor. Here is the Report:-

|

Quarterly |

Dec-20 |

Sep-20 |

Jun-20 |

Mar-20 |

Dec-19 |

|

Sales |

85 |

70 |

67 |

69 |

59 |

|

Other Income |

10 |

7 |

13 |

10 |

9 |

|

Total Income |

96 |

78 |

81 |

79 |

69 |

|

Total Expenditure |

19 |

19 |

24 |

21 |

16 |

|

EBIT |

76 |

58 |

56 |

58 |

52 |

|

Interest |

0 |

0 |

0 |

0 |

0 |

|

Tax |

17 |

14 |

14 |

11 |

10 |

|

Profit |

58 |

44 |

42 |

47 |

42 |

|

Quarterly (%) |

Dec-20 |

Sep-20 |

Jun-20 |

Mar-20 |

|

Growth in Sale |

21.4 |

4.5 |

-2.9 |

16.9 |

|

Growth in Profit |

31.8 |

4.8 |

-10.6 |

11.9 |

· Ratios: The Margin, Return, liquidity, and other ratio indicates the good valuation of stock. The Ratios increase Every year and Every Quarter.

|

|

Qtr Wise |

|

Yr Wise |

|

|

|

Ratio |

Dec-20 |

Sep-20 |

Jun-20 |

Mar-20 |

Mar-19 |

|

Basic EPS (Rs.) |

2.01 |

1.57 |

1.44 |

5.89 |

5.47 |

|

Diluted Eps (Rs.) |

2.01 |

1.57 |

1.44 |

5.89 |

5.46 |

|

Book Value (Rs.) |

- |

16.02 |

- |

13 |

12.26 |

|

Dividend/Share (Rs.) |

- |

- |

- |

2.5 |

0 |

|

Face Value |

1 |

1 |

1 |

1 |

1 |

|

Gross Profit Margin (%) |

- |

- |

- |

94.28 |

95.6 |

|

Operating Margin (%) |

- |

- |

- |

88.35 |

91.49 |

|

Net Profit Margin (%) |

81.81 |

74.29 |

69.50 |

68.33 |

64.95 |

|

Return on Networth /

Equity (%) |

- |

9.75 |

- |

45.29 |

44.57 |

|

ROCE (%) |

- |

8.8 |

- |

52.6 |

58.08 |

|

Return On Assets (%) |

- |

16.81 |

- |

26.33 |

23.39 |

|

Current Ratio (X) |

- |

2.28 |

- |

1.46 |

1.27 |

|

Quick Ratio (X) |

- |

- |

- |

1.46 |

1.27 |

|

Debt to Equity (x) |

- |

0.64 |

- |

0 |

0 |

|

Interest Coverage Ratios

(%) |

- |

- |

- |

145.11 |

316.64 |

|

Asset Turnover Ratio (%) |

- |

10.66 |

- |

38.53 |

36.01 |

|

Inventory Turnover Ratio

(X) |

- |

- |

- |

0 |

0 |

|

3 Yr CAGR Sales (%) |

- |

- |

- |

1,503.53 |

1,493.99 |

|

3 Yr CAGR Net Profit (%) |

- |

- |

- |

1,225.59 |

1,184.68 |

|

P/E (x) |

28.32 |

33.06 |

31.18 |

21.72 |

30.16 |

|

P/B (x) |

- |

12.94 |

- |

9.84 |

13.41 |

|

EV/EBITDA (x) |

- |

14.54 |

- |

15.62 |

20.16 |

|

P/S (x) |

- |

19.59 |

- |

14.84 |

19.54 |

· Moving Average:- IEX indicate strong moving average.

|

Moving Average |

|

|

Day |

Price |

|

5 |

351.21 |

|

10 |

330.72 |

|

20 |

315.53 |

|

50 |

277.68 |

|

100 |

243.63 |

|

200 |

216.38 |

MAs are used primarily as trend indicators

and also identify support and resistance levels. The two most common MAs are

the simple moving average (SMA), which is the average price over a given number

of time periods, and the exponential moving average (EMA), which gives more

weight to recent prices. Both of these build the basic structure of the Forex

trading strategies below.

· Increase in Shareholdings :- As Per report of last quarter shareholding, DII Increase their shareholding in it as,

Ø

Mutual Funds have increased holdings from 18.22%

to 20.0% in Dec 2020 qtr.

Ø

Number of MF schemes increased from 12 to 16 in

Dec 2020 qtr.

Ø

Number of FII/FPI investors increased from 146

to 147 in Dec 2020 qtr.

Ø

Institutional Investors have increased holdings

from 65.29% to 66.24% in Dec 2020 qtr.

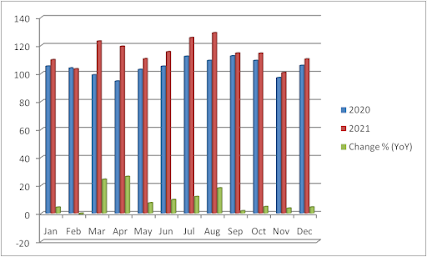

Here is the Chart of DII holding(%)

· Indian Gas Exchange:- Indian Gas Exchange is a wholly owned subsidiary of IEX, which involves in trading spot and forward contracts of Gas. Indian Gas Exchange Ltd. is India’s first automated national level Gas Exchange to promote and sustain an efficient and robust Gas market and to foster gas trading in the country. The exchange has over 500 registered clients and 15 members. It currently operates from three physical hubs — Hazira, Dahej and KG Basin. Shareholding of IGX as on 10-03-021 :- 26% - National Stock Exchange of India, 5% - Oil and Natural Gas Corporation, 5% - Adani Gas, 5% - Torrent Gas, 5% - GAIL Rest 54% - Indian Energy Exchange.

· SWOT of IEX.

Strengths:-

1.

Company with high TTM EPS Growth

2.

New 52 Week High

3.

Good quarterly growth in the recent results

4.

Growth in Net Profit with increasing Profit

Margin (QoQ)

5.

Company with No Debt

6.

Increasing Revenue every quarter for the past 2

quarters

7.

Increasing profits every quarter for the past 2

quarters

8.

FII / FPI or Institutions increasing their

shareholding

9.

Stock gained more than 20% in one month

10.

Strong Momentum: Price above short, medium and

long term moving averages

Weakness:-

1.

Declining Net Cash Flow : Company not able to

generate net cash

Opportunity:-

1.

Brokers upgraded recommendation or target price

in the past three months

2.

Positive Breakout First Resistance ( LTP >

R1)

3.

Highest Recovery from 52 Week Low

4.

High Volume, High Gain

Threats:-

1.

Red Flag: Resignation of Top Management

2.

Increasing Trend in Non-Core Income

3.

Stocks with high PE (PE > 40)

Green Trade

Munish Mahajan

Comments

Post a Comment