MTAR Technologies IPO Date, Review, Price Band, Form & Market Lot Details

MTAR

Technologies

MTAR

Technologies Limited incorporated in 1999 based in Hyderabad. They are leading

player in precision engineering industry in India. They are manufacturer of

mission critical precision components with close tolerances (5-10 microns),and

in critical assemblies, to serve projects of high national importance, through

our precision machining, assembly, testing, quality control, and specialized

fabrication competencies, some of which have been indigenously developed and

manufactured.

They have

big client names like ISRO, NPCIL, DRDO, Bloom Energy, Rafael, Elbit, among

others. Their product portfolio includes product portfolio of the company

includes critical assemblies such as Liquid propulsion engines to GSLV Mark

III, Base Shroud Assembly & Airframes for Agni programs, Actuators for LCA,

power units for fuel cells, Fuel machining head, Bridge & Column, Thimble

Package, Drive Mechanisms etc. to the core of the nuclear reactor.

|

MTAR Technologies IPO Date &

Price Band |

|

|

IPO Open: |

03 March 2021 |

|

IPO Close: |

05 March 2021 |

|

IPO Size: |

Approx ₹596 Crore |

|

Face Value: |

₹10 Per Equity Share |

|

Price Band: |

₹574 to ₹575 Per Share |

|

Listing on: |

BSE & NSE |

|

Retail Portion: |

35% |

|

Equity: |

10,372,419 Shares |

|

MTAR Technologies IPO Market Lot |

|

|

Minimum Lot Size: |

Minimum 26 Shares |

|

Minimum Amount: |

₹14950 |

|

Maximum Lot Size: |

Maximum 338 Shares |

|

Maximum Amount: |

₹194350 |

|

MTAR Technologies IPO Allotment

& Listing |

|

|

Basis of Allotment: |

10 March 2021 |

|

Refunds: |

12 March 2021 |

|

Credit to Demat Account: |

15 March 2021 |

|

Listing Date: |

16 March 2021 |

|

MTAR Technologies Company Financial

Report |

|||

|

₹ in Crore |

|

|

|

|

|

Revenue |

Expense |

Net Income |

|

2017 |

- |

- |

- |

|

2018 |

161 |

143 |

5.4 |

|

2019 |

186 |

146 |

39.2 |

|

2020 |

218 |

173 |

31.3 |

|

2021 9M |

178 |

138 |

28.1 |

My

Point of View

MTAR

Technologies, the maker of nuclear, defence and aerospace equipment, is hitting

the market with Rs 600 crore initial public offer (IPO) on March 3. The price

band for the three-day IPO, which closes on March 5, has been fixed at Rs 574-575

per share. The lot size is 26 and in multiples thereof, which means you can bid

for a minimum of 26 equity shares and in multiples of 26 shares thereafter.

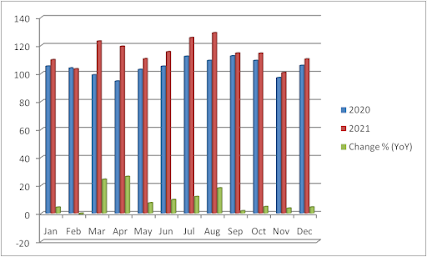

MTAR is good company for long-term investment. The Sale increase year on year

basis. The detail is below:

Always apply for IPO on last day after getting the subscription status and response in first two days. The first thing to check before investing in IPO is the subscription times.

Green Trade

Munish Mahajan

Comments

Post a Comment