Penny Stock that have Potentional to Turn Multi-Bagger: - Series 1

Penny Stock that have Potentional to Turn Multi-Bagger: - Series 1

Indian Stock Market is a place where a number of stocks goes Sky high from the earth low. Like Bajaj Finance, Bajaj FinServ, Infosys, Titan etc. every stock in starting age was a penny stock.

Today we will discuss about some stocks which are undervalued but have potential to turn multi-bagger.

Gokul Agro Resource Ltd.

Share Price:- 40.55

GARL is India's one of the prime processers and manufacturers of various Edible & Non Edible oil and allied products. GARL’s product range consists of all the major Edible oil consumed globally and among the Non-edible segment. GARL is one of the largest Castor Oil producing companies. GARL cater to the Feed Meal industry of the world by supplying them high quality meal of Soybeans and at with Castor producing unit we produce high quality Castor Meal which is an Organic Fertiliser by itself. With wide range of customers of diverse and multicultural beliefs they present in more than 20 different states of a large country like India with a remarkable brand presence. GARL with its globally renowned customer base and through the excellence of the quality products cater a large customer base across the world in many continents.

My Point of View.

GARL is the leading company of Edible Oil products. GARL is the 3rd largest company of Edible oil India after KSE Ltd and Rochi Soya. Edible Oil used in frying, baking, and other types of cooking. Edible oil or cooking oil is a household product whose demand increased day to day. India imports 15 million tonne of edible oil annually and the domestic production is only 7.5-8.5 million tonne. GARL is a company which have potential to fulfil the demand of oil in future. GARL deliver its product to 20 Different countries like Argentina, Canada China Russia and USA include India.

Let’s discuss the point which attract GARL :-

1. GARL is the 3rd largest company of Edible Oil in India.

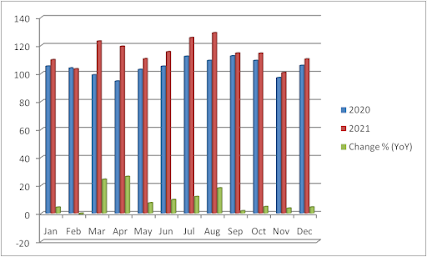

2. Company Revenue and Profit Growth :- Let us see the financial of GARL. Company revenue or profit increases on YOY basis which is a good sign for the investor. Here is the Report:-

| Mar-21 | Mar-20 | Mar-19 | Mar-18 | Mar-17 |

Sales | 7,668 | 4,751 | 4,270 | 4,279 | 4,261 |

Other Income | 13 | 11 | 9 | 10 | 21 |

Total Income | 7,682 | 4,763 | 4,280 | 4,290 | 4,283 |

Total Expenditure | 7,571 | 4,662 | 4,189 | 4,206 | 4,199 |

EBIT | 110 | 100 | 90 | 84 | 83 |

Interest | 56 | 79 | 82 | 66 | 53 |

Tax | 19 | 6 | 3 | 4 | 10 |

Net Profit | 34 | 14 | 5 | 12 | 19 |

Annually | Mar-21 | Mar-20 | Mar-19 | Mar-18 | |

Growth in Sale % | 61.4 | 11.3 | -0.21 | 0.42 | |

Growth in Profit % | 143 | 180 | -58.3 | -36.8 |

3. Ratios:- Here is the chart

Per Share Ratios | Mar-21 | Mar-20 | Mar-19 | Mar-18 | Mar-17 |

Basic EPS (Rs.) | 2.63 | 1.09 | 0.39 | 0.98 | 1.49 |

Diluted Eps (Rs.) | 2.63 | 1.09 | 0.39 | 0.98 | 1.49 |

Book Value [Excl. Reval Reserve]/Share (Rs.) | 19.6 | 16.97 | 15.89 | 15.51 | 14.53 |

Dividend/Share (Rs.) | 0 | 0 | 0 | 0 | 0 |

Face Value | 2 | 2 | 2 | 2 | 2 |

Gross Profit Margin (%) | 1.82 | 2.58 | 2.82 | 2.61 | 2.45 |

Operating Margin (%) | 1.44 | 2.12 | 2.12 | 1.96 | 1.96 |

Net Profit Margin (%) | 0.45 | 0.3 | 0.11 | 0.3 | 0.45 |

Return on Networth / Equity (%) | 13.4 | 6.42 | 2.44 | 6.3 | 10.21 |

ROCE (%) | 31.67 | 31.23 | 34.05 | 33.03 | 36.77 |

Return On Assets (%) | 2.81 | 1.08 | 0.4 | 1.03 | 1.54 |

Current Ratio (X) | 1.11 | 1.06 | 1.02 | 1 | 1.01 |

Quick Ratio (X) | 0.69 | 0.59 | 0.55 | 0.59 | 0.67 |

Debt to Equity (x) | 0.47 | 0.96 | 1.39 | 1.63 | 1.48 |

Interest Coverage Ratios (%) | 1.97 | 1.27 | 1.1 | 1.26 | 1.57 |

Asset Turnover Ratio (%) | 623.37 | 359.03 | 335.84 | 342.5 | 336.77 |

Inventory Turnover Ratio (X) | 20.86 | 10.14 | 9.03 | 10.34 | 12.1 |

3 Yr CAGR Sales (%) | 33.85 | 5.59 | 8.45 | 149.57 | 6,428.07 |

3 Yr CAGR Net Profit (%) | 63.87 | -14.32 | -39.95 | 91.16 | 342.61 |

P/E (x) | 7.68 | 7.75 | 29.62 | 18.83 | 17.21 |

P/B (x) | 1.03 | 0.48 | 0.76 | 1.21 | 1.77 |

EV/EBITDA (x) | 2.08 | 1.94 | 2.84 | 4.09 | 3.72 |

P/S (x) | 0.03 | 0.02 | 0.04 | 0.06 | 0.08 |

4. Stock Return After Every QTR Result :- GARL gives good return in every QTR. Here is the chart. In chart you can see the result date and the price. Every QTR stock give good return as per following chart:-

F.Y. | Qtr | Date | Open | Close | Return on Every Qtr Result (%) |

2019-2020 | Sep | 11-11-2019 | 13.2 | 15.15 | 14.77 |

2019-2020 | Dec | 13-02-2020 | 8.25 | 13.55 | 64.24 |

2019-2020 | Mar | 05-06-2020 | 13.55 | 15.85 | 16.97 |

2020-2021 | June | 27-07-2020 | 15.8 | 13.9 | -12.03 |

2020-2021 | Sep | 05-11-2020 | 13.9 | 23.7 | 70.50 |

2020-2021 | Dec | 02-02-2021 | 23.7 | 24.95 | 5.27 |

2020-2021 | Mar | 17-05-2021 | 25.45 | 41.5 | 63.06 |

5. Moving Average:-

Moving Average | |

5 | 40.83 |

10 | 41.19 |

20 | 42.36 |

50 | 33.72 |

100 | 27.94 |

200 | 22.38 |

MAs are used primarily as trend indicators and also identify support and resistance levels. The two most common MAs are the simple moving average (SMA), which is the average price over a given number of time periods, and the exponential moving average (EMA), which gives more weight to recent prices. Both of these build the basic structure of the Forex trading strategies below.

6. Price Performance of GARL

Price Performance | |

1 Week | -1.22% |

1 Month | -1.10% |

3 Months | 99.75% |

YTD | 103.77% |

1 Year | 154.23% |

3 Years | 200.37% |

Let’s Discuss the Strengths of GARL

· Company with high TTM EPS Growth

· High Revenue and Profit Growth with High Return on Capital Deployed (ROCE) and Low PE ratio

· Growth in Net Profit with increasing Profit Margin (QoQ)

· Growth in Quarterly Net Profit with increasing Profit Margin (YoY)

· Increasing Revenue every Quarter for the past 4 Quarters

· Increasing profits every quarter for the past 2 quarters

· Strong cash generating ability from core business - Improving Cash Flow from operation for last 2 years

· Company able to generate Net Cash - Improving Net Cash Flow for last 2 years

· Annual Net Profits improving for last 2 years

· Book Value per share Improving for last 2 years

· Companies with rising net profit margins - quarterly as well as TTM basis

Some General answer Queries about Stock

Q) Company consistently making profits?

A) Yes

Q) Are earnings improving over years?

A) Yes

Q) Does recent earnings show strength?

A) Yes

Q) Are Profit Margins stable?

A) Yes

Q) Does company consistently making money for its Shareholder?

A) Yes

Q) Company with low Debt?

A) Yes

Q) Is company able to meet its working capital requirments?

A) Yes

Q) Does company generates cash from operations?

A) Yes

Q) Does Promoter holds adequate holding in company?

A) Yes

Q) Company with Low Promoter Pledge?

A) Yes

Q) Are Institutions investing in company?

A) No

Q) Is company growing above Industry Median?

A) Yes

Q) Are Profit Margin above Industry median?

A) No

Q) Efficient in utilizing its Asset to generated Profits against its Peers?

A) Yes

Q) No Insiders Sold stock in last 1 month?

A) Yes

Munish Mahajan

Founder of Green Trade Securities.

Great research n Analysis 👌💪

ReplyDelete