Penny Stocks that have Potential to Turn Multi-Bagger:- Series 2

Penny

Stocks that have Potential to Turn Multi-Bagger:- Series 2

Indian Stock Market is a place where a number of stocks goes

Sky high from the earth low, like Bajaj Finance, Bajaj FinServ, Infosys, Titan

etc. every stock in starting age was a penny stock. Last time we discuss about GARL which was

trading at Rs.40.55 on 04-Jul-2021. CMP of GARL as on 19-Jul-2021 is Rs.40.85, but

in between, stock made a high of Rs.43.9.

Today we will discuss about other stocks which are

undervalued but have potential to turn multi-bagger.

Share Price:- 31.10

Rail Vikas Nigam Limited is a wholly owned subsidiary of

Indian Railways involved in building rail infrastructure required by the

railways.

Rail Vikas Nigam Limited (RVNL) was incorporated as a Public Sector Undertaking for the mandate to:

·

Mobilize financial and human resources for project

implementation

·

Ensure timely execution of projects with least

cost escalation

·

Maintain a cost effective organizational set up

·

Encourage public private participation in rail

related projects managed by RVNL

·

Be an infrastructure Project Execution Company

committed to sustainable development and environment friendly construction

practices of rail related projects in the country

·

Acquire, purchase, license, concession or assign

Rail infrastructure assets including contractual rights and obligation with the

approval of more whenever required

ROLE OF

RAIL VIKAS NIGAM LIMITED (RVNL)

RVNL has been assigned the

following functions:

·

Arranging financial resources for the Projects.

For this purpose, the RVNL is authorized to approach the Financial Institutions,

Banks, Domestic Market and the Bilateral and Multilateral Funding Agencies

·

Undertaking project development and execution of

works

·

Creating Project specific SPVs for individual

works, if required

·

Commercialization of projects wherever

considered necessary and feasible

·

On completion of a Railway project by RVNL, the

concerned Zonal Railway will undertake its operation and maintenance under a

specific financial arrangement

·

For providing a revenue stream to RVNL, the

projects may be done by RVNL on BOT concept, where Ministry of Railways is to

pay Access Charge/User Charge

My Point

of View

Rail Vikas Nigam Limited is a

wholly owned subsidiary of Indian Railways involved in building rail

infrastructure required by the railways. RVNL is Listed on BSE and NSE. RVNL

came into existence on 24th March 2003 as a 100% owned PSU of the

Ministry of Railway. It became fully functional by March 2005.

RVNL is in list of Miniratna-I of Public Sector Undertakings

in India. National High Speed Rail

Corporation of India is subsidiary of RVNL.

Let’s

discuss the point which attract RVNL:-

1.

RVNL is one of the largest railway

infrastructures company in India.

2.

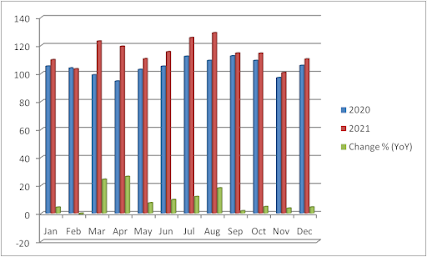

Company Revenue and Growth :- Let us see

the financial of RVNL. Company revenue or profit increases on YOY basis which

is a good sign for the investor. Here is the Report:-

3. Ratio Chart :- Here is the chart.

4.

Moving Average :- The Moving Average Chart :-

5.

Price Performance of RVNL :- Price Performance Chart :-

6.

Dividend Yield :- 5.08%. Every year RVNL

give a dividend of 5% of Stock price. Imagine you hold 1000 shares at Rs.31.10.

Your Total Investment is Rs.31150. After a year if RVNL share price remains stable

at 31.10. You could get 1555 as dividend. You get your 5% return in Cash.

Imagine if the stock gives 10% return, you can get total return of 15%.

7.

NHSRCL :- NATIONAL HIGH SPEED RAIL

CORPORATION LIMITED is the Wholly owned subsidiary of RVNL.

Let’s

Discuss the Strengths of RVNL :-

·

Increasing Revenue every quarter for the past 3

quarters.

·

Increasing profits every quarter for the past 3

quarters.

·

Annual Net Profits improving for last 2 years.

·

Book Value per share Improving for last 2 years.

·

High dividends, with rising dividend yields over

last five years.

·

Company with Zero Promoter Pledge.

·

Company able to generate Net Cash - Improving

Net Cash Flow for last 2 years.

·

Stock with Low PE (PE < = 10). Less PE mean

Next Multi-bagger.

Some

General answer Queries about Stock

A.

Company consistently making profits?

Yes.

B.

Are earnings improving over years?

Yes.

C.

Does recent earnings show strength?

Yes.

D.

Are Profit Margins stable?

Yes.

E.

Does company consistently make money for its

Shareholder?

Yes.

F.

Company with low Debt?

Yes.

G.

Is company able to meet its working capital

requirments?

Yes.

H.

Does company generate cash from operations?

No.

I.

Ownerships?

Yes.

J.

Does Promoter hold adequate holding in company?

Yes

K.

Company with Low Promoter Pledge?

Yes

L.

Are Institutions investing in company?

Yes

M.

Is company growing above Industry Median?

Yes

N.

Are Profit Margin above Industry median?

No

O.

Efficient in utilizing its Asset to generated

Profits against its Peers?

Yes

P.

No

Insiders Sold stock in last 1 month?

Yes

Munish Mahajan

Founder of Green Trade Securities.

Comments

Post a Comment