Is Glenmark Life Science Good Bet for Long-Term Investment?

Glenmark Life Science list at 751

with just 4% premium on Indian Stock Exchange as on 06 August 2021. Glenmark

Life Sciences initial public offering had received strong response from

investors as the offer was subscribed 44.17 times during July 27-29, 2021. The Non-institutional

investors reserved portion was subscribed 122.54 times, the qualified

institutional buyers were subscribed 36.97 times and the retail portion

received 14.63 times subscription. Due to downtrend in Pharma Sector, Glenmark

Life Science listed at Just 4% Premium after getting good subscription.

Glenmark

Life Science Limited

Glenmark Life Sciences is an API arm of Glen Mark Pharma, a

leading drug maker. They are one of the leading developer and manufacturer of

Active Pharmaceutical Ingredients (APIs).

Who They

Are?

They are in the business of making high-quality drugs by

unlocking the possibilities of science. Over the years, they have established

strong relationships with leading global generic pharmaceutical companies that

have helped us expand our product offerings and geographical reach. They worked

with 16 of the 20 largest generic companies globally. They have 120 API in

their catalogue. They supply high-quality APIs to more than 540 pharma

companies in multiple countries.

What They

Do?

They are a research and development (R&D)-driven API

manufacturer, focused on undertaking dedicated R&D in our existing products

and in areas where they believe there is growth potential in the future. They have

steadily built scale in our product offerings and reach, leveraging

state-of-the-art laboratories and manufacturing locations. Glenmark Life

Science partners with 16 of the top 20 generic companies in the world.

My Point

of View

Glenmark Life Sciences is an API arm of Glenmark Pharma, a leading drug maker. Glenmark Pharma is a leading manufacturer of Drugs. Company Manufacture lots of Product Like –

Candid - used

to treat fungal infections of the skin,

Scalpe - Use for Reduces dandruff, prevents itching, flaking & scaling on the scalp and Prevents hair fall,

Eptus - Used for heart failure and high blood

pressure.

Hair4u - Used

for treat common hereditary hair loss.

Favipiravir -

Glenmark becomes the first pharmaceutical company in India to receive

regulatory approval for oral antiviral Favipiravir, for the treatment of mild

to moderate COVID-19.

Itraconazole

capsules–As on 15-06-2021, Glenmark Pharma get CDSCO (Central Drugs

Standard Control Organization) Panel NOD for Manufacturing and Marketing of Itraconazole

capsules. Itraconazole capsules are used to treat fungal infections in the

lungs that can spread throughout the body.

All

these Drugs are commonly used in India.

Glenmark export their products in Europe, Latin America,

North America, Japan, and the rest of the world. Glenmark Life Science partners

with 16 of the top 20 generic companies in the world. Considering all these

factors it is very good bet for long-term investment.

Now Take a look on credentials which show Glenmark Life

Science is a Good Stock for Long Term.

· Key Point of Glenmark Life Science: -

·

This year, Glenmark Life science Achieved

milestone of 403 cumulative drug master files (DMFs) across multiple markets

globally (DMF-A Drug Master File (DMF) is a submission to the Food and Drug

Administration (FDA) that may be used to provide confidential detailed

information about facilities, processes, or articles used in the manufacturing,

processing, packaging, and storing of one or more human drugs.)

·

Polar Capital Funds - Healthcare Opportunities

Fund bought 8,36,000 equity shares (0.68% stake) of Glenmark Life Sciences at

an average price of Rs 732.55 per equity share via bulk deals on the NSE as on

09 August 2021.

·

Glenmark Life Sciences is the Active Pharma

Ingredients (API) arm of Glenmark Pharma and has been accounting for about

30-35% of its overall value. Glenmark Pharma has been a listed stock for over

20 years and has a reputation for delivering solid long-term returns. The

Glenmark Life Sciences provides an opportunity to participate in the

high-growth API segment, which is expected to grow at 8.5% CAGR over next 5

years.

·

Glenmark Life Sciences derives 90% of its

revenues from APIs and 10% from CDMO. Within APIs, Glenmark Life is present in

the mid-margin generic API segment and the higher margin complex API segment.

Most of the APIs manufactured by Glenmark Life are non-commoditized and cater

to specialized areas like cardio vascular, central nervous system, diabetes,

pain management etc.

·

Glenmark Life has a Blue-Chip global clientele.

As of 2020, 16 out of the 20 largest generic manufacturers in the world are

customers of Glenmark Life. Nearly 70% of the global customers of Glenmark Life

are repeat customers indicating high loyalty coefficient. Its client list includes

Teva Pharmaceuticals, Torrent Pharma, Aurobindo Pharma, KRKA and a host of

other generic leaders across the world.

·

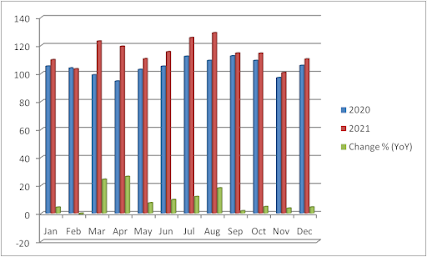

Glenmark has consistently delivered on numbers

and its top line and bottom line speak for themselves. Revenue from operations

has more than doubled in the last 2 years to Rs.1,886 crore in FY21. EBITDA

margins in the last 2 years have grown from 28% to 31.40% putting it in top

league of API margins. Net profits are up 80% over last 2 years and the ROCE

has increased from 18.21% in FY19 to 32.69% in FY21.

·

Company Promoters hold 83% holding in the

Company.

·

Company delivers good return on equity. In

Financial year 2021, the company’s return on Equity is 46.71%. The Weighted

Average Return on Equity is 65.88 on last 3 Year.

i.

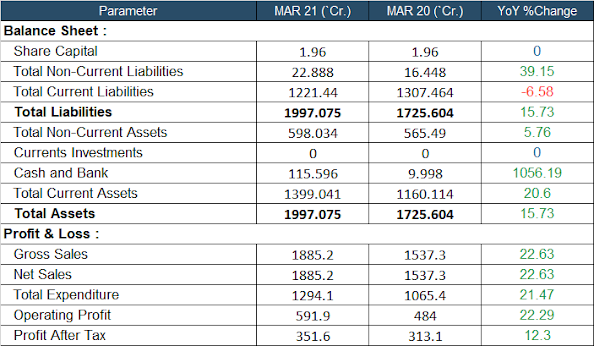

Parameter of the Company – Here is the combine working of Bs and P&L of Glenmark

Life Science,

· Company has strong Balance sheet.

·

The

Assets portion of the company is looking good as compare with liabilities.

· Company has Sufficient liquid cash to

meets its future requirement.

· The Sale Increase YoY Basis

· Company has Good Operating and Net

Profit which increase YoY Basis.

In last, Glenmark Life Science is Good Looking Company under

Pharmaceuticals & Drugs Sector. Indian Pharmaceuticals & Drugs Sector

give 29.61% return this year. Indian Pharmaceuticals & Drugs Sector is in top

3 Leading Sector in Indian Stock Market. Looking at its Sector, financial and

Growth, we can expect a good long-term return on this Stock.

Disclaimer

Munish Mahajan

Green Trade Securities

👍 👍 👍

ReplyDeleteThanks for sharing the blog, seems to be interesting and informative too. To find out more details Click Here

ReplyDeleteHeadlines Insider is a full-time Digital marketing service provider based in India. We are a team of Ninja's who know the in and out of online marketing campaigns, guest blogger, design and developments. We are a hardcore team of madmen of advertising and marketing!

ReplyDeleteThis information is very helpful. Thank You for sharing such valuable information with us. Apply Online Bank Account

ReplyDelete